National Statistics

Canadian Housing Activity Sees Another Quiet Month in May What it Means For You

Ottawa, ON June 17, 2024 – While May was another relatively uneventful month for many Canadian housing markets with national month-over-month home sales edging slightly lower and new listings moving only a little higher, the Bank of Canada’s recent rate drop will likely lead to increased activity moving forward.

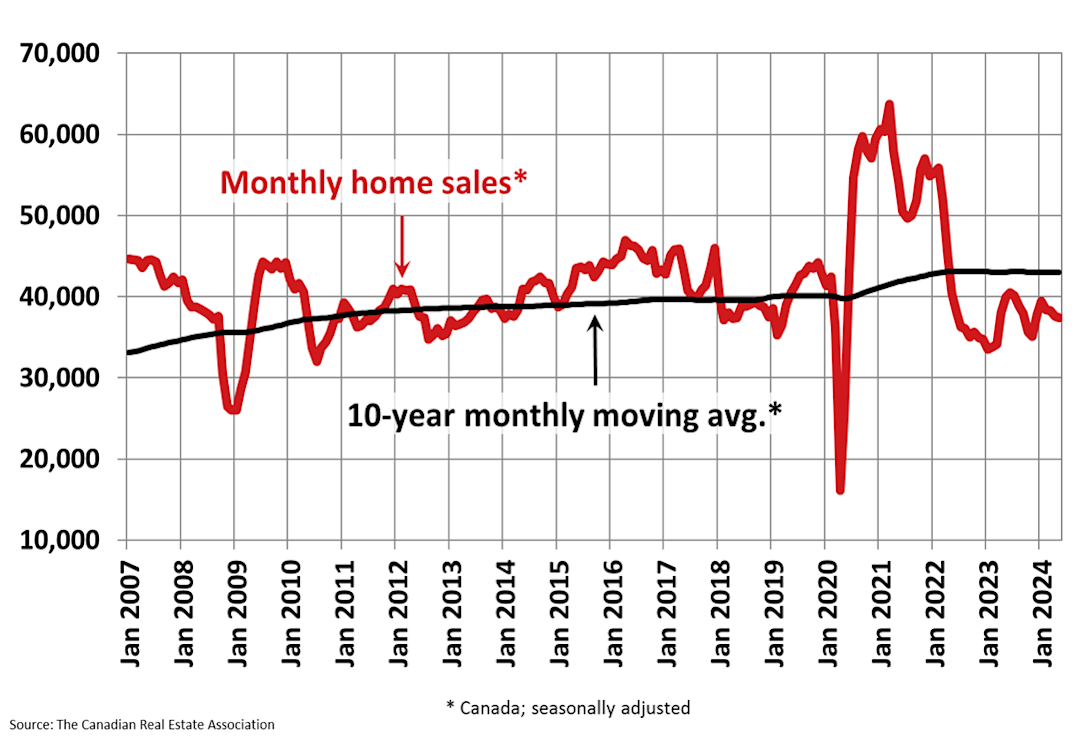

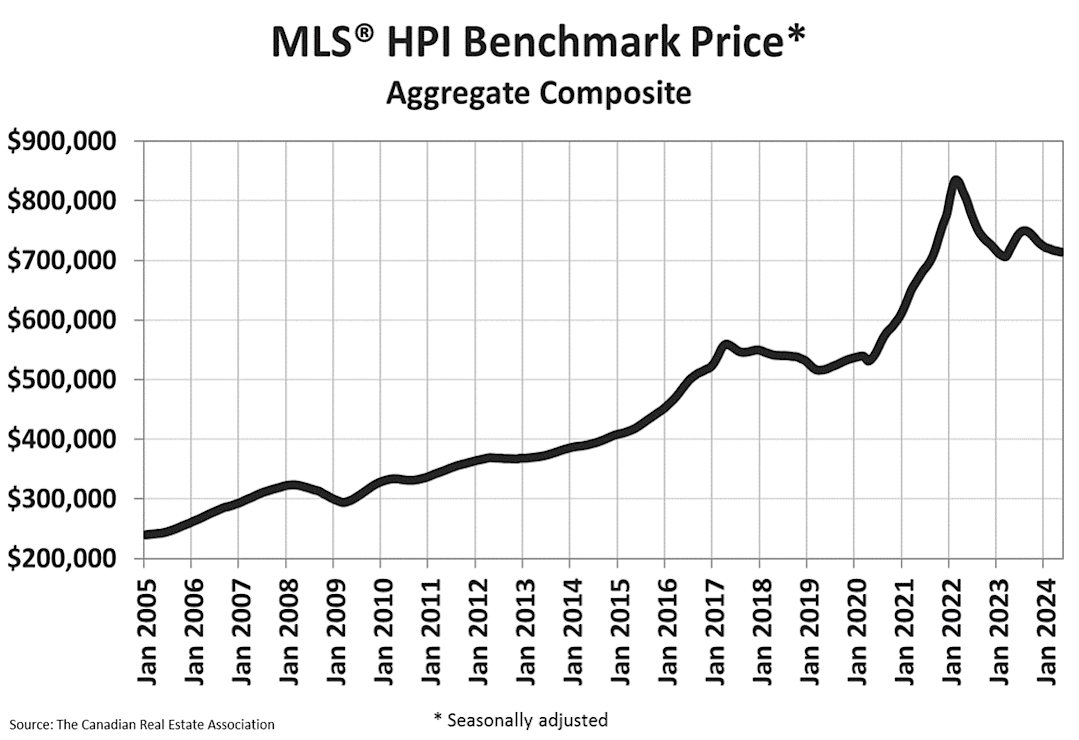

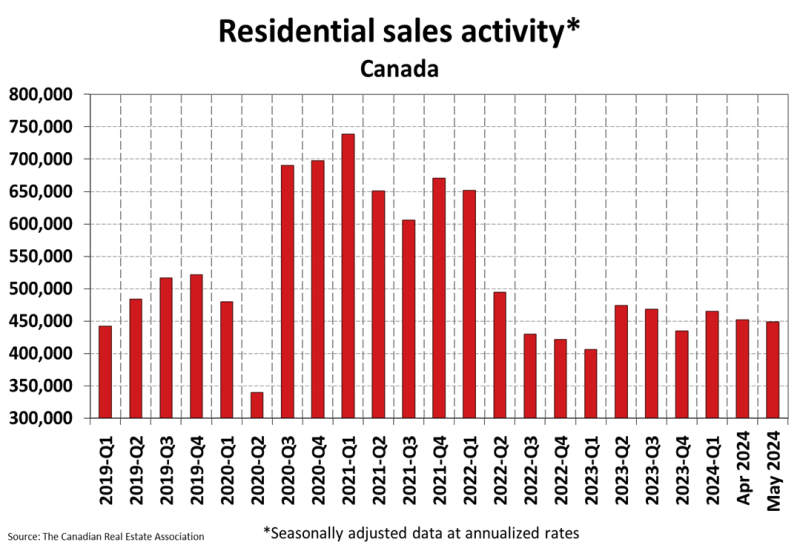

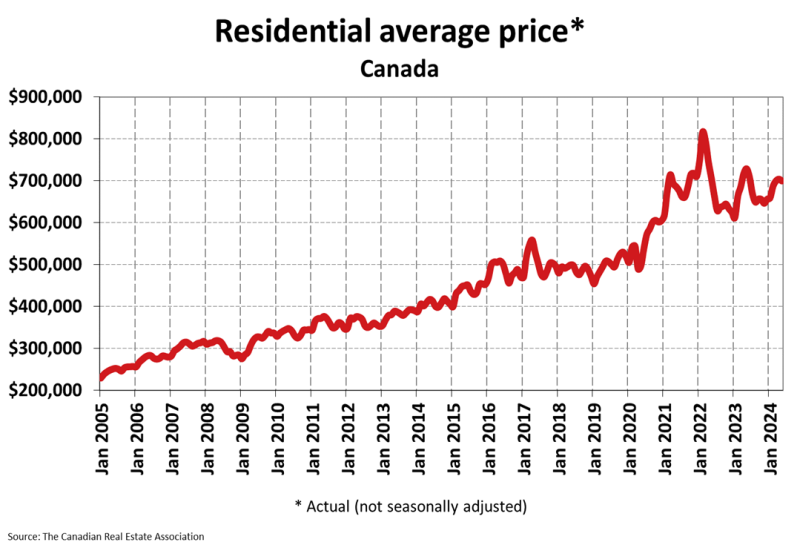

Home sales activity recorded over Canadian MLS® Systems dipped 0.6% between April and May 2024, remaining a little below the average of the last 10 years. (Chart A) Home prices are also largely sliding sideways.

“May was another sleepy month for housing activity in Canada, although it may prove to be the last of those now that interest rates have moved lower,” said Shaun Cathcart, CREA’s Senior Economist. “The Bank of Canada’s June 5 rate cut may have only been 25 basis points, but the psychological effect for many who have been sitting on the sidelines was no doubt huge. The question now turns to further rate cuts – specifically, how fast, and how far?”

Highlights:

- National home sales edged back 0.6% month-over-month in May.

- Actual (not seasonally adjusted) monthly activity came in 5.9% below May 2023.

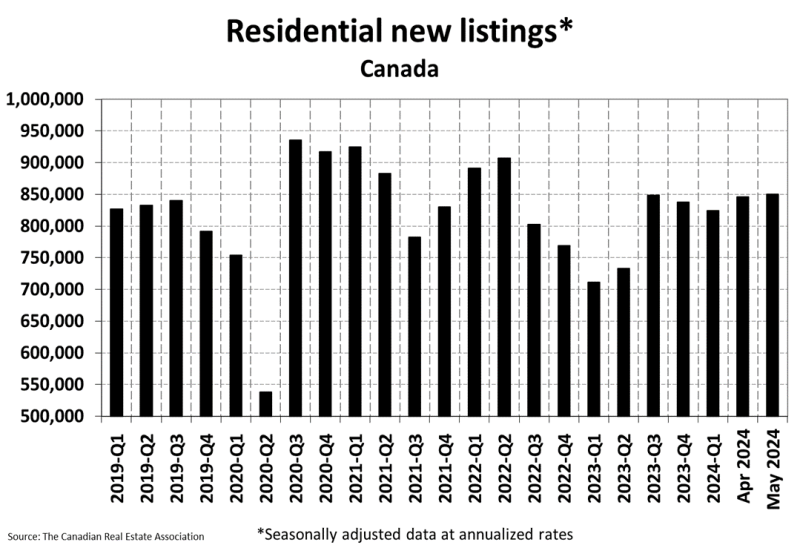

- The number of newly listed properties ticked up 0.5% month-over-month.

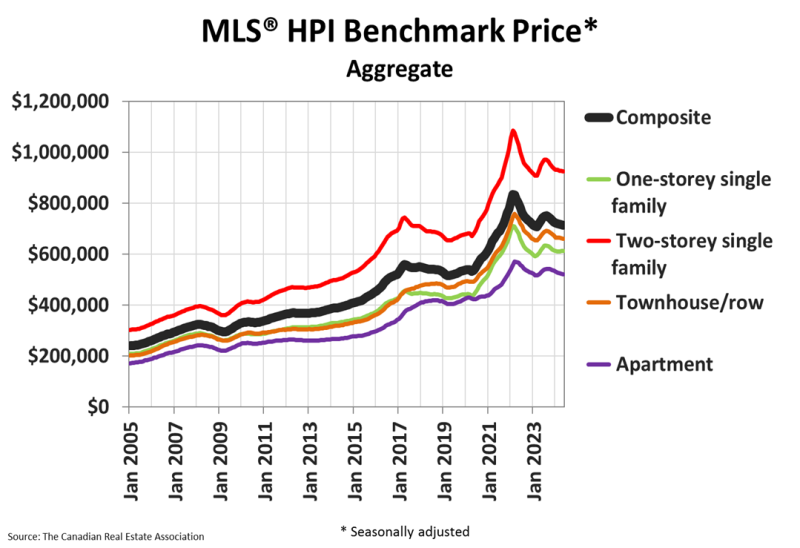

- The MLS® Home Price Index (HPI) dipped 0.2% month-over-month and was down 2.4% year-over-year.

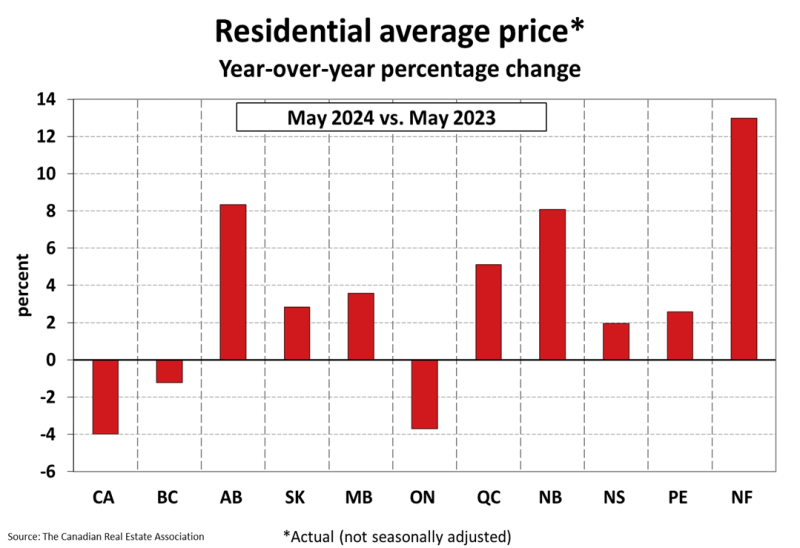

- The actual (not seasonally adjusted) national average sale price posted a 4% year-over-year decrease in May.

Chart A

The number of newly listed homes was up in May, though only by 0.5% on a month-over-month basis. The result of slower sales amid more new listings this year has been an increasing number of homes for sale across a majority Canadian housing markets.

As of the end of May 2024, there were about 175,000 properties listed for sale on all Canadian MLS® Systems, up 28.4% from a year earlier but still below historical averages.

“The spring housing market usually starts before all the snow has melted, somewhere around the beginning of April, but this year I believe a lot of people were waiting for the Bank of Canada to wave the green flag,” said James Mabey, Chair of CREA. “That first rate cut is expected to bring some pent-up demand back into the market, and those buyers will find there are more homes to choose from right now than at any other point in almost five years. If you’re thinking about jumping into the market now that interest rates are moving down, hire a REALTOR® where you live – or might like to – today.”

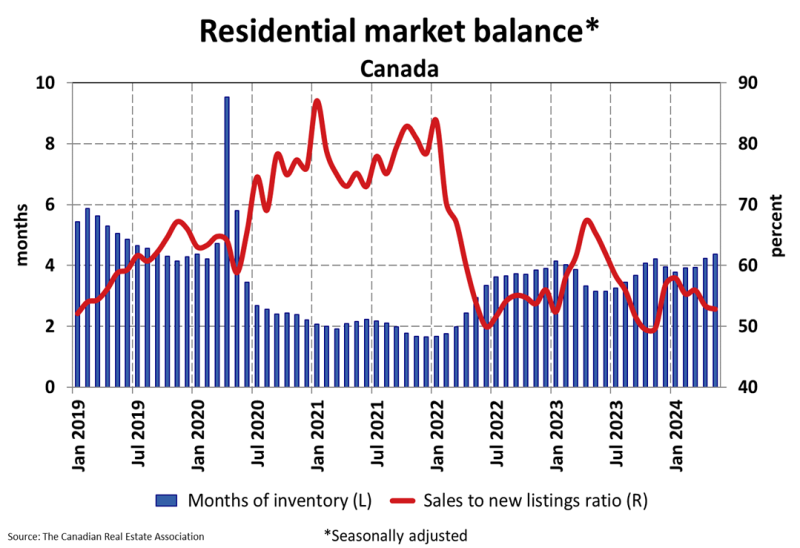

With sales down slightly and new listings up a little in May, the national sales-to-new listings ratio eased to 52.6% compared to 53.3% in April. The long-term average for the national sales-to-new listings ratio is 55%. A sales-to-new listings ratio between 45% and 65% is generally consistent with balanced housing market conditions. There were 4.4 months of inventory on a national basis at the end of May 2024, up from 4.2 months at the end of April and, looking past the volatility at the onset of the COVID-19 pandemic, the highest level for this measure since the fall of 2019. The long-term average is about five months of inventory. The National Composite MLS® Home Price Index (HPI) dipped 0.2% from April to May. (Chart B)

Chart B

Regionally, prices are generally sliding sideways across most of the country right now. The exceptions remain Calgary, Edmonton, and Saskatoon, where prices have steadily ticked higher since the beginning of last year.

The non-seasonally adjusted National Composite MLS® HPI stood 2.4% below May 2023. This mostly reflects how prices took off starting last April, something that hasn’t yet been repeated in 2024.

The actual (not seasonally adjusted) national average home price was $699,117 in May 2024, down 4% from May 2023.

NATIONAL RESIDENTIAL STATISTICS

Reference: The Canadian Real Estate Association

Looking to create your investment strategy? I can help with that.

Get in touch today and let me help you find just the right place. Click on the link or me at 604-376-3350 to get the process started.

If you are looking to buy or sell, I can help. Get in touch today!

Looking for a one-of-a-kind place to call home?

Want reasonable terms on your purchase agreement?

Want expert guidance on the home purchase process?

ABOUT LIZ PENNER YOUR BEST LANGLEY REAL ESTATE AGENT

Liz Penner is a top-selling licensed real estate salesperson with the Fraser

Valley Real Estate Board and has been a top-selling realtor specializing in the residential resale of condos, townhomes, and houses for over a decade. Liz assists residents of the Langley and Surrey areas to sell real estate while looking out for the client’s best interests. Liz also helps first-time homebuyers, families, and repeat purchasers with their property search process, ensuring that her clients get access to the very best homes on the market while receiving excellent service ensuring that they find the perfect place to call home.

Liz holds a BBA in leadership and has completed a variety of specific training through the Fraser Valley Real Estate Board in the areas of selling strata properties, foreclosures, estate sales, and new construction properties. Liz is also well versed in POAs, the Strata Property Act, and more. If you are looking for a knowledgeable and professional real estate agent that is willing to do everything possible to ensure that you get top dollar for the sale of your home or to find the dream home you are looking for in the Surrey and Langley, BC areas then get in contact today.

If you are looking for a knowledgeable and professional real estate agent that is willing to do everything possible to ensure that you get top dollar for the sale of your home or to find the dream home you are looking for in the Surrey and Langley, BC areas then get in contact today.

WHY LIST YOUR HOME FOR SALE WITH LIZ PENNER

-

- I’ve helped sell over 400 properties throughout the Langley and Cloverdale area, and I’d love the opportunity to do the same for you.

-

- I’ve experienced straightforward sales and sales that have gone off the rails, back on the rails, off the rails, and then back on again. That’s just the way the real estate train rolls, and it never rattles me.

-

- I’ve got a solid toolkit to pull from when a problem arises. I take my job seriously each time, and I will make sure you get top dollar for your Fraser Valley, Langley, or Cloverdale home, smooth sailing, or otherwise.