BCREA Economics Mortgage rate Forecast

Highlights

- Canadian mortgage rates down sharply to start 2024.

- The Canadian economy – no recession yet, but growth is very slow.

- Waiting for the Bank of Canada to cut.

Mortgage Rates

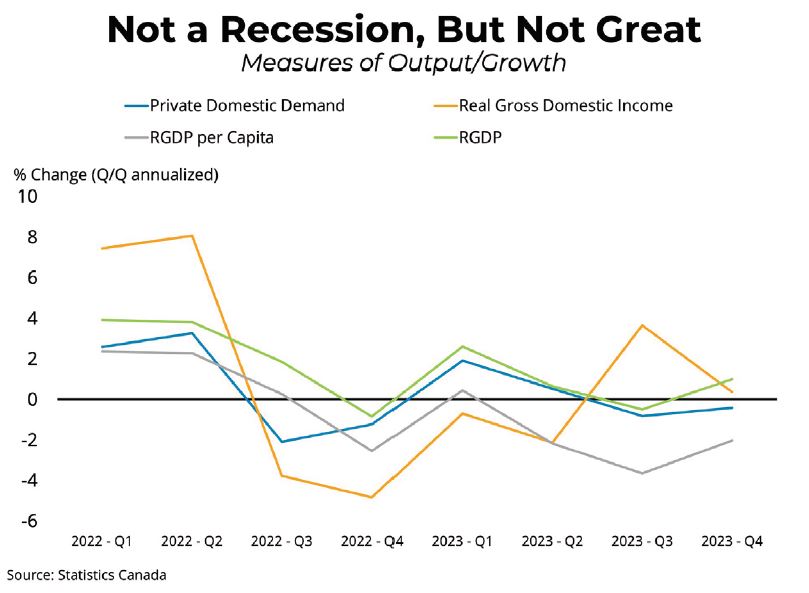

In early October 2023, Canadian five-year bond yields peaked at a 17-year high of 4.42 per cent. Over the next four weeks, bond yields plummeted more than 100 basis points. The catalyst for the dramatic swing in the cost of borrowing seems to have occurred following better-than-expected inflation data in both the US and Canada, starting in the early fall and continuing to the end of 2023. As a result, the expectations of financial markets for the timing and magnitude of monetary easing by the Bank of Canada shifted substantially toward more aggressive rate cuts on the horizon.

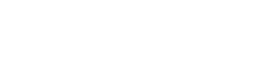

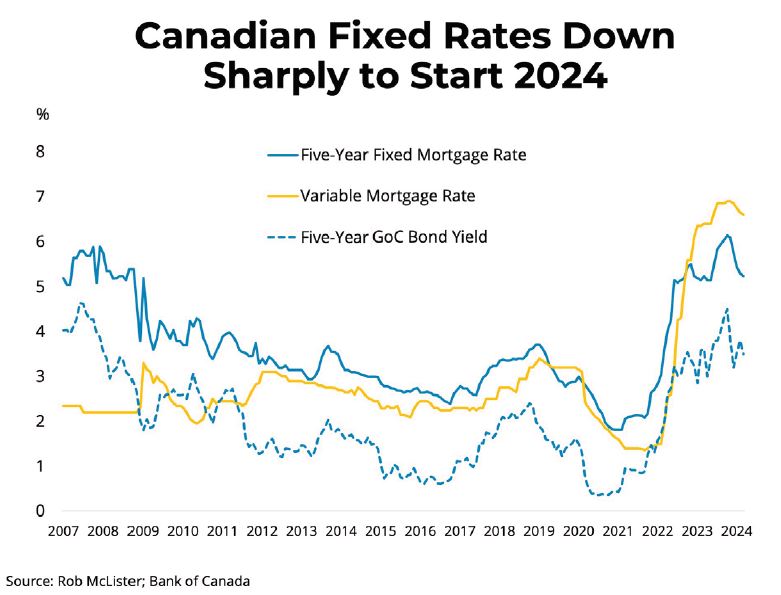

While markets seemed to have gotten ahead of themselves, with yields backing up slightly in February, the current trend for five-year bond yields implies a five-year fixed mortgage rate of about 5.2 per cent. That is very close to the current average offered rate among major lenders and not far from where we expected rates to be by the end of 2024, though obviously arriving well ahead of our forecast.

Discounts offered on variable rates have increased slightly from prime minus 30 basis points to prime minus 60 basis points, prompting a slight decline in average variable rates. However, a more substantial downward move in variable rates will have to wait for the Bank of Canada to act. Once the Bank begins cutting, we expect variable rates will fall about 100 basis points by the end of the year.

Economic Outlook

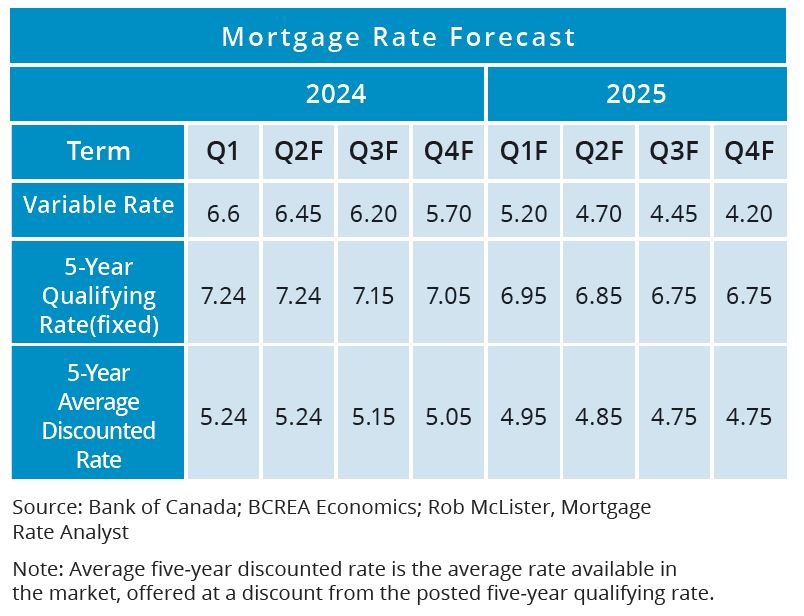

The Canadian economy managed to eke out meagre growth in the fourth quarter to narrowly avoid a technical recession, often defined as two consecutive quarters of negative real GDP growth. That said, the Canadian economy appears rather sickly by a wide range of measures. While Canada’s falling real GDP per capita, or how much Canada is producing relative to its population, has been extensively covered, other alternative measures of growth are also underperforming. In particular, the growth of Private Domestic Demand, which measures the strength of spending by Canadian firms and households, has been negative for two quarters, and growth of real gross domestic income, essentially the sum of Canadian wages and profits, only recently returned to positive territory.

Juxtaposed against a sluggish economy, however, is the surprising robustness of the Canadian labour market. While employment growth is not quite keeping up with Canada’s rapidly expanding population, the economy is adding jobs month after month, including more than 40,000 jobs in February. The national unemployment rate has maintained near 5.8 per cent, up from a record low of 4.8 per cent in 2022 but essentially on par with the pre-pandemic rate of unemployment. Moreover, wage growth has topped 5 percent for the last three months, outpacing inflation by a wide margin.

Bank of Canada Outlook

Although financial markets clearly got ahead of themselves toward the end of 2023, pricing-in an unlikely six rate cuts by the Bank of Canada, it remains overwhelmingly likely that the Bank of Canada will begin lowering its policy rate this year. There is also little mystery as to how much the Bank will eventually cut, with a consensus forming around the Bank stopping at 2.5 per cent, or 250 basis points lower than today. The only open question is when the Bank will implement its first rate cut. Probabilities from financial markets are strongly tilted toward the Bank cutting by 25 basis points at its June meeting, with about a more than 90 per cent probability of 100 basis points of cuts by the end of December.

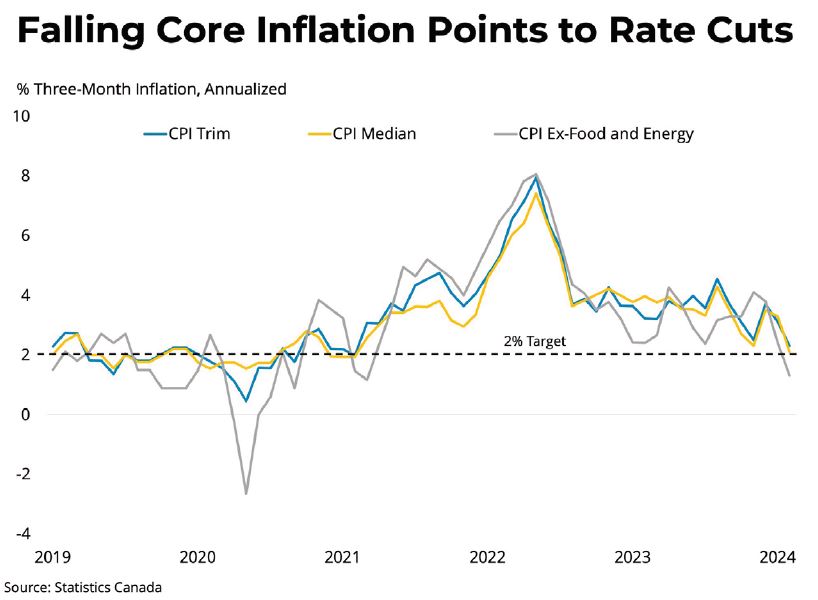

However, as the Bank itself made very clear with its March decision, further progress will need to be made, bringing core inflation down below 3 per cent for policymakers to be convinced they are not acting too early only to have to reverse course later on. Given that core inflation dropped dramatically in February, and given the sluggish pace of the Canadian economy it would seem that an April rate cut is not out of the question and if not April, then almost certainly June.

Reference: BREA Mortgage Rate Forecast March 2024

Looking to create your investment strategy? I can help with that.

Get in touch today and let me help you find just the right place. Click on the link or me at 604-376-3350 to get the process started.

If you are looking to buy or sell, I can help. Get in touch today!

Looking for a one-of-a-kind place to call home?

Want reasonable terms on your purchase agreement?

Want expert guidance on the home purchase process?

ABOUT LIZ PENNER YOUR BEST LANGLEY REAL ESTATE AGENT

Liz Penner is a top-selling licensed real estate salesperson with the Fraser

Valley Real Estate Board and has been a top-selling realtor specializing in the residential resale of condos, townhomes, and houses for over a decade. Liz assists residents of the Langley and Surrey areas to sell real estate while looking out for the client’s best interests. Liz also helps first-time homebuyers, families, and repeat purchasers with their property search process, ensuring that her clients get access to the very best homes on the market while receiving excellent service ensuring that they find the perfect place to call home.

Liz holds a BBA in leadership and has completed a variety of specific training through the Fraser Valley Real Estate Board in the areas of selling strata properties, foreclosures, estate sales, and new construction properties. Liz is also well versed in POAs, the Strata Property Act, and more. If you are looking for a knowledgeable and professional real estate agent that is willing to do everything possible to ensure that you get top dollar for the sale of your home or to find the dream home you are looking for in the Surrey and Langley, BC areas then get in contact today.

If you are looking for a knowledgeable and professional real estate agent that is willing to do everything possible to ensure that you get top dollar for the sale of your home or to find the dream home you are looking for in the Surrey and Langley, BC areas then get in contact today.

WHY LIST YOUR HOME FOR SALE WITH LIZ PENNER

-

- I’ve helped sell over 400 properties throughout the Langley and Cloverdale area, and I’d love the opportunity to do the same for you.

-

- I’ve experienced straightforward sales and sales that have gone off the rails, back on the rails, off the rails, and then back on again. That’s just the way the real estate train rolls, and it never rattles me.

-

- I’ve got a solid toolkit to pull from when a problem arises. I take my job seriously each time, and I will make sure you get top dollar for your Fraser Valley, Langley, or Cloverdale home, smooth sailing, or otherwise.